Detecting Fake Expense Reports: A Playbook for HR and Finance Teams

Sep 8, 2025

- Team VAARHAFT

(AI generated)

Generative AI has made it possible to invent a restaurant dinner or a week-long hotel stay with a few sentences of text. On 31 March 2025, TechCrunch showed how the new GPT-4o image generator can create photo-realistic receipts that fool the eye in seconds. The post went viral among finance professionals because it proved a point many had suspected: the barrier to expense-claim fraud has collapsed. This article explains why the risk is real, where traditional controls break down, and how leaders can build an AI-first defence that can detect fake expense reports before they drain budgets.

The new anatomy of an expense-claim scam

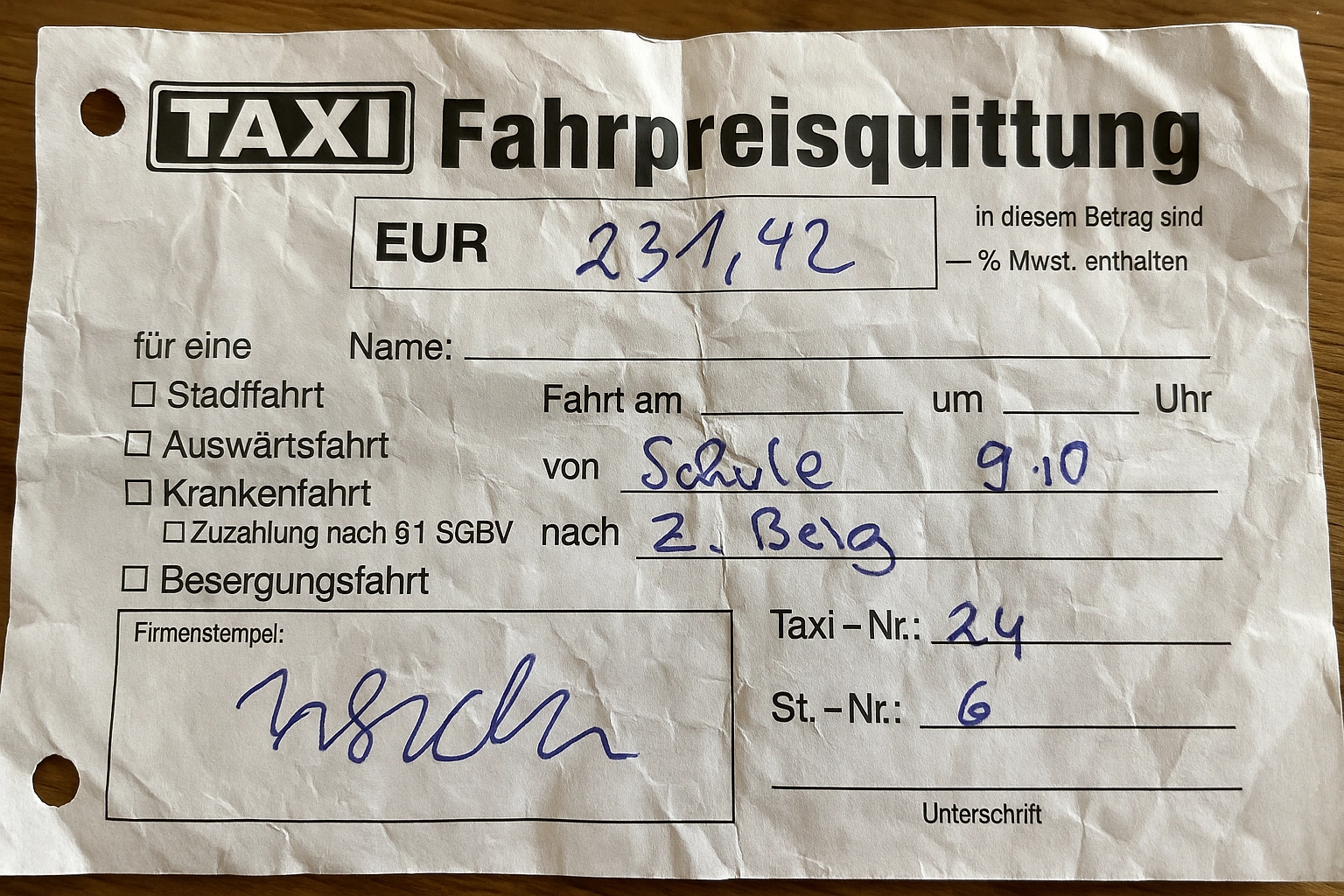

Fake receipts used to require a printer, a scanner and some Photoshop skills. Today any traveller can prompt an image model to invent a crumpled taxi stub or a five-star hotel invoice complete with local sales tax. This 2024 Deloitte forecast even places the potential losses from AI-driven claim fraud at 11.5 billion dollars by 2027. That number reflects three converging trends: synthetic creation of entirely new receipts, pixel-level editing of authentic documents, and cargo-cult duplication in which the same file is recycled across subsidiaries. Together these tactics undermine any process that relies on manual review or superficial text checks. If finance teams hope to identify forged receipts in travel expense reports they need technology that examines the pixels and the context, not just the words.

Why manual review is falling short

1. Volume: a medium-sized enterprise handles tens of thousands of claims per quarter, and human reviewers can sample only a fraction.

2. Sophistication: detecting fake hotel invoices and meal receipts now requires forensic analysis of shading, noise patterns and embedded metadata that most reviewers do not possess.

3. Speed pressure: employees expect next-day reimbursement, so deeper checks are often skipped.

4. Distributed work: remote staff submit claims from dozens of locations and countries, complicating cross-checking against local formats.

5. Insider bias: line managers are reluctant to accuse colleagues, so employee fraud prevention becomes reactive.

The result is a compliance blind spot; by the time auditors uncover anomalies, funds are rarely recoverable and credibility with regulators is damaged.

Building an AI-layered defence

The most mature programmes use three layers.

Layer 1 – document authenticity check: a computer-vision engine scans every submitted file for the statistical fingerprints of editing software or generative AI. Heatmaps highlight altered regions, making manipulated PDF expense documents detection immediate.

Layer 2 – duplicate and pattern analysis: privacy-preserving fingerprints spot the same receipt reused across entities, enabling organisations to prevent duplicate receipts in expense reporting.

Layer 3 – secure recapture on demand: when risk is high, the claimant retakes images through a browser-based camera flow that blocks screenshots, mirroring how SafeCam reinforces trust.

Key signals the authenticity engine should evaluate

- Metadata mismatch such as creation time later than transaction time or stripped C2PA fields

- Compression artefacts that vary across regions of the same receipt

- Font anomalies including non-standard kerning or glyph substitution common in synthetic text

- Geometry distortions like straight edges on a supposedly crumpled paper

- Cross-claim similarities where identical invoice numbers surface in separate submissions

Leaders seeking deeper technical context on provenance metadata can review Vaarhaft’s analysis of the standard and its gaps here. For a complementary HR scenario, see how forged CVs are detected in hiring workflows here.

Generative receipts will only become more convincing. Finance and HR teams that act now can stay ahead of the curve, protect budgets and strengthen compliance. Explore how Vaarhaft Fraud Scanner and SafeCam combine to catch fraud in seconds and keep honest employees moving; schedule a personalised demo with our team today.

.png)